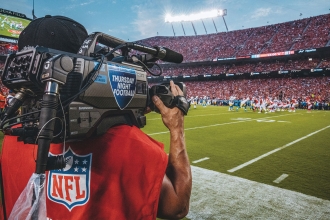

Prime Video’s Thursday Night Football game between the Kansas City Chiefs and the San Diego Chargers at Arrowhead Stadium

Serious About Streaming

After discovering the fountain of youthful viewers on Amazon last season, the biggest audience-driver in all of television — the NFL — looks to take its direct-to-consumer game to the next level. That includes the first-ever exclusive livestream of a pivotal postseason matchup.

The NFL started streaming games back in 2015 with a fairly conservative playbook. It tossed a proverbial screen pass when it drew 33.6 million livestreams on Yahoo for a game at London's Wembley Stadium. Presented in the United States during the wee dawn hours, the game featured two teams, the Buffalo Bills and Jacksonville Jaguars, that didn't even make the playoffs that year.

For the 2022 season, however, the league finally threw long, signing a bold eleven-year deal with Prime Video that pays the NFL about $1 billion per season to exclusively stream its Thursday Night Football package.

On the surface, the NFL had a rough first season in its first streaming-only go-round with Prime Video; TNF's total viewer average of 9.6 million was down 41 percent from the previous campaign, when Fox aired most Thursday night NFL matchups. The game schedule itself turned out to be uncompetitive; announcer Al Michaels remarked at one point that enticing viewers to watch the events felt like "selling a used car."

For the season ahead, the NFL has taken steps to improve its Thursday night schedule. But Prime Video and the league are also grappling with another challenge: some older viewers, accustomed since birth to searching around the dial or the cable TV grid, simply aren't yet in the habit of clicking on Prime Video to find football.

Younger NFL watchers, on the other hand, know exactly where to go. TNF's performance among men 18–34 last season improved 18 percent over 2021, representing the NFL's best draw in that demo on any TV channel since 2014. And among the all-important adults 18– 49 demo, TNF averaged 4.7 million viewers, up around 14 percent, with the package beating everything on linear cable and broadcast for fifteen weeks last fall.

The NFL, which saw the median age of a Super Bowl viewer creep up to just over forty-nine in 2020, had expected it might attract a younger audience by streaming its more meaningful games. Last year's committed move to Prime Video confirmed just that.

Not everyone sees the NFL's "reach for youth" tradeoff as a win, however.

"Who cares if they grew adults 18–49 by 14 percent if they also drive overall viewing down by over 40 percent?" says Patrick Crakes, a former Fox Sports executive turned sports media consultant.

At the same time, the NFL subscribes to Netflix's contention that in the future, all TV will be streamed. It just has to get viewers onto its playbook.

The NFL points to data suggesting viewers are leaning toward streaming. In January, the digital marketing agency Adtaxi published survey results that suggested nearly a third of prospective Super Bowl watchers intended to stream the big game.

This coming season, live NFL games — the biggest, most consistent audience driver in all of television — will not only have exclusive streaming windows on Prime Video but will expand to YouTube and Peacock as well.

NBCUniversal, eager to grow its subscription streaming service, in May agreed to pay the league $110 million for exclusive streaming rights to a single NFL playoff game for the first time. On Saturday, January 13, 2024, an AFC Wild Card playoff game will air on NBC and Peacock, before a second Wild Card game streams exclusively on Peacock right after, in primetime.

That's kind of a big deal.

In January 2023, a comparable Saturday primetime Wild Card matchup — featuring Jacksonville's stunning comeback win over the Los Angeles Chargers — averaged 20.6 million viewers for NBC.

As for YouTube, it's getting exclusive rights to NFL Sunday Ticket, the premium package that gives subscribers access each Sunday to every live NFL regular-season game not being played in their market. Since its inception way back in 1994, the package had been available only to DirecTV customers.

Late last year, Alphabet (parent of Google and YouTube) agreed to pay the NFL $2 billion per season to take over Sunday Ticket. The tech giant will make that package available to subscribers of its $73-per- month streaming pay-TV platform, YouTube TV, for an additional fee that has been priced as low as $300 with promotions. And Google will also make Sunday Ticket available for non-pay-TV subscribers, delivering it as a standalone streaming product for the first time.

Google has promised to innovate the Sunday Ticket viewer experience beyond the format DirecTV provided for decades; it will add elements like multiple viewing screens to track different games simultaneously, as well as interactive features like comments, chats and polls.

As for the NFL's business with YouTube and other streaming companies, the Sunday Ticket agreement "is only the beginning," league commissioner Roger Goodell told advertisers in May at YouTube's New York upfront presentation.

Last year, eighty-two of the 100 most-watched broadcasts in the United States were NFL games, up from seventy-five in 2021 and seventy-one in 2020. That the most powerful remaining force in traditional TV is moving its crown jewels into streaming shouldn't be surprising, considering the backdrop.

In the first three months of 2023, cord-cutting reached an all- time high, as 2.3 million customers gave up cable plans. Now, even ESPN — long seen as the lynchpin holding the pay-TV system together — is making plans to migrate its flagship cable channel into a standalone streaming offering.

ESPN, which charges an industry-high average of around $9 per pay-TV subscriber to carry its flagship channel, is making plans to migrate its full offering to streaming in a product that would usurp ESPN+, its current, far lighter subscription streaming channel. In May, ESPN chairman Jimmy Pitaro told Bloomberg, "That's a when, not an if."

Meanwhile, major professional sports leagues beyond the NFL are making plans to increase their commitment to streaming. Apple, which has an $85 million-per-year deal with Major League Baseball to show Friday Night Baseball doubleheaders, is said to be interested (along with Prime Video) in assuming national rights to the NBA, once that league's current $2.7 billion-per-year TV deal with Disney and Warner Bros. Discovery's Turner Networks expires at the end of the 2024–25 season.

Prime Video may be close to entering the NASCAR business, too, with the racing league reportedly ready to license its second-tier circuit — the Xfinity Series — to the e-commerce giant. Also starting in 2024, Prime Video appears likely to get exclusive TV rights to the summer trimester portion of NASCAR's premier racing circuit, the NASCAR Cup Series, with Fox retaining the spring trimester (which features the Daytona 500) and NBC holding on to the fall "playoffs" portion.

Not everyone sees this rush to streaming as a great idea. For one thing, adding Amazon and YouTube increases the number of distributors of live NFL action to seven. That means avid NFL fans have to subscribe to even more services to catch all the games.

And beyond limiting mass-audience reach, livestreaming technology still isn't perfect. There's the issue of "latency" — the amount of time between when the camera captures the action and when viewers at home actually see it. For cable and broadcast, latency is typically under ten seconds.

But for February's most recent Super Bowl, research company Phenix found that latency was around one full minute for livestreamed pay-TV services YouTube TV, Hulu + Live TV and Fubo. It's not ideal when you hear a neighbor scream "Touchdown!" almost a minute before you see the big play on your television.

Some pundits also see the potential for modern replays of the infamous Heidi situation. That occurred in 1967, when NBC cut away from the dramatic final moments of an NFL game between the Oakland Raiders and the New York Jets to show a previously scheduled made-for-TV kids movie.

Last May, during the pivotal final eight minutes of game one of the NBA's Eastern Conference Finals matchup (Miami Heat versus Boston Celtics), YouTube TV's livestream suddenly froze in the middle of a Disney movie commercial.

Warren Sharp, who covers the NFL for Fox Sports, tweeted his displeasure: "Little Mermaid frozen on the screen while Jimmy Buckets is lighting it up in the 4th quarter. The NBA's 'Heidi Game' (look it up youngsters)."

This article originally appeared in emmy magazine issue #9, 2023, under the same title.